In this week’s recap: Stocks struggle to find their way amid several noteworthy earnings reports from corporations.

Weekly Economic Update

Presented by Pinecrest Financial, May 3, 2021

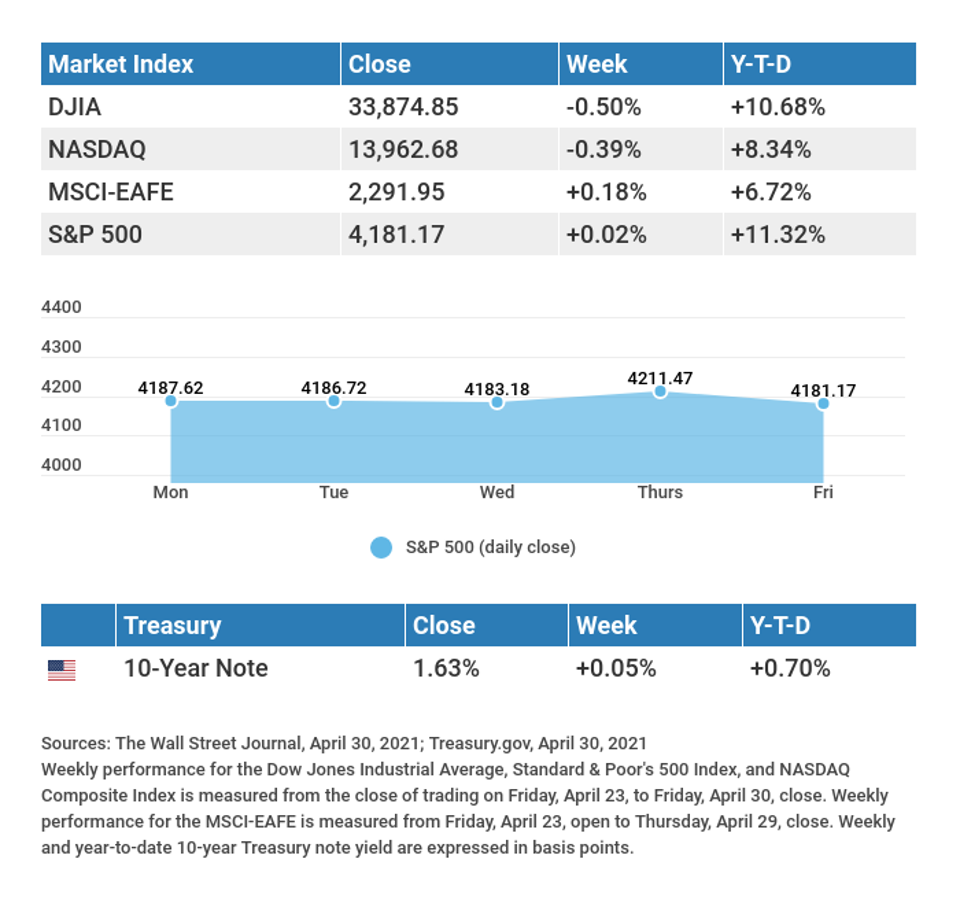

THE WEEK ON WALL STREET Stocks meandered around a flatline in a busy week of corporate earnings, ending the trading week slightly lower. The Dow Jones Industrial Average slid 0.50%, while the Standard & Poor’s 500 was flat (+0.02%). The Nasdaq Composite index surrendered 0.39%. The MSCI EAFE index, which tracks developed overseas stock markets, rose 0.18%.1,2,3 Seeking Direction Though the S&P 500 and Nasdaq established new record highs at the start of the week, stocks struggled to find traction as the week wore on.4 Investor sentiment was dampened by rising COVID-19 infections in India and Japan, along with mounting inflation worries. Stocks finally caught some lift from strong quarterly reports issued by two big technology companies and an upbeat first-quarter Gross Domestic Product growth number, sending the S&P 500 to a fresh record high.5 Once again, though, stocks failed to follow through, as the market retreated in the final day of trading to close near where it began the week. Earnings Top Expectations Last week was the biggest week of the first quarter’s earnings season with a third of S&P 500 companies reporting, including six of the largest companies.6 With expectations high, businesses generally topped Wall Street analysts’ estimates; Big Tech companies posted especially noteworthy earnings. Coming into last Friday, with 40% of S&P 500 index companies reporting, earnings-per-share growth (EPS) is now estimated to be 29.3%, well ahead of the 12.2% EPS growth rate that analysts had expected at the start of the year.7

T I P O F T H E W E E K

Think about setting up a system to record your allowable income tax deductions and credits. Too many people spend too many hours trying to figure out deductions and credits in April.

THE WEEK AHEAD: KEY ECONOMIC DATA Tuesday: Factory Orders. Wednesday: ADP (Automated Data Processing) Employment Report. ISM (Institute for Supply Management) Services Index. Thursday: Jobless Claims. Friday: Employment Situation Report. Source: Econoday, April 30, 2021 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. THE WEEK AHEAD: COMPANIES REPORTING EARNINGS Tuesday: CVS Health Corporation (CVS), Pfizer, Inc. (PFE), Dominion Energy (D), Prudential Financial (PRU). Wednesday: Paypal Holdings (PYPL), General Motors (GM), Twilio, Inc. (TWLO), Etsy, Inc. (ETSY), Cognizant Technologies (CTSH). Thursday: Square, Inc. (SQ), Roku, Inc. (ROKU), Albemarle Corporation (ALB), Regeneron Pharmaceuticals, Inc. (REGN), Booking Holdings (BKNG), Expedia Group (EXPE), Kellogg Company (K). Friday: Berkshire Hathaway (BRK.A), EOG Resources (EOG), Cigna Corporation (CI), Draftkings, Inc. (DKNG). Source: Zacks, April 30, 2021 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Q U O T E O F T H E W E E K

“The secret of happiness isn’t found in seeking more, but in developing the capacity to enjoy less.”

SOCRATES

T H E W E E K L Y R I D D L E

Forward I am heavy, but backward I am not. What am I?

LAST WEEK’S RIDDLE: A certain month can begin on a Friday and end on a Friday as well. What month is it?

ANSWER: February. In order for a month to start and end with the same day of the week, it has to have a complete number of weeks and have one more day. The only possible month is February which has 29 days in a leap year.

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2021 FMG Suite. CITATIONS:

- The Wall Street Journal, April 30, 2021

- The Wall Street Journal, April 30, 2021

- The Wall Street Journal, April 30, 2021

- CNBC, April 26, 2021

- The Wall Street Journal, April 29, 2021

- MarketWatch, April 25, 2021

- The Earnings Scout, April 30, 2021