In this week’s recap: Inflation concerns continue as the Fed weighs scaling back of bond purchases.

Weekly Economic Update

Presented by Pinecrest Financial, May 24, 2021

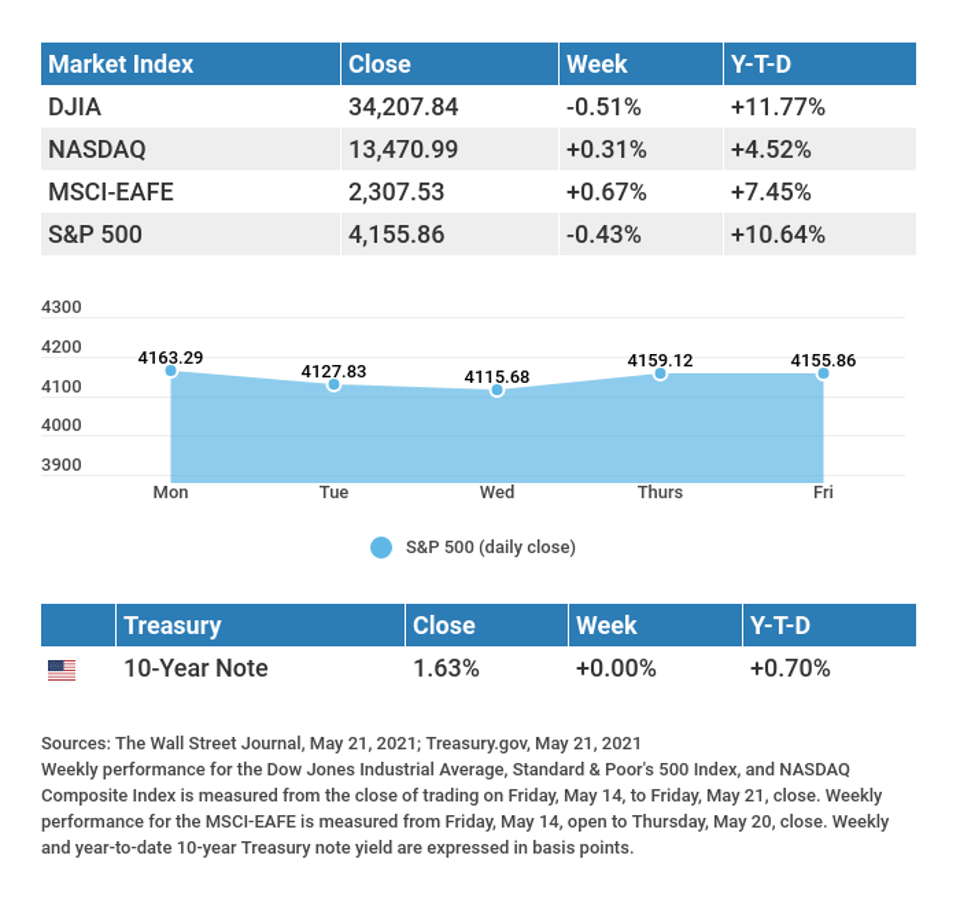

THE WEEK ON WALL STREET Stock prices fluctuated amid inflation concerns and bargain hunting, leaving stocks mixed for the week. The Dow Jones Industrial Average slipped 0.51%, while the Standard & Poor’s 500 dropped 0.43%. The tech-heavy Nasdaq Composite index advanced 0.31%. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.67%.1,2,3 LOTS OF MOTION, LITTLE MOVEMENT Stocks began last week extending their losses from the previous week, as the slide in technology and other high-growth stocks resumed. Inflation worries also weighed on the market. After steep declines in early Wednesday trading, market sentiment took a more positive turn, allowing stocks to pare their losses as the session came to a close, despite news that the Fed could be contemplating tapering its monthly bond purchases.4 This positive momentum continued into Thursday, aided by a declining initial jobless claims number and a strong rebound in technology. The rebound lost steam into Friday’s close, leaving stocks little changed for the week.5 THE FED HINTS AT A TURN The Federal Open Market Committee (FOMC) on Wednesday released the minutes of its April meeting. The report suggested that a number of committee participants had raised the idea that—if the economy continues to make progress— it might be appropriate to adjust the pace of the Fed’s monthly bond purchase program.4 With inflation appearing to accelerate, the markets have been watchful for signs that the Fed would begin tightening its easy-money policies. This is the first time since the pandemic that the Fed has suggested that a scaling back of bond purchases could happen, though no timetable was discussed. It’s important to note that the April Fed meeting took place prior to the release of April’s Consumer Price Index, which showed a higher-than-expected increase of 4.2%.6

T I P O F T H E W E E K

Think about sending your children to a college that is both good and affordable. If your kids are debt-free when they graduate, they may end up starting their working lives in a better financial position than many of their peers.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: New Home Sales. Consumer Confidence. Thursday: Jobless Claims. Durable Goods Orders. Gross Domestic Product (GDP). Source: Econoday, May 21, 2021 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. THE WEEK AHEAD: COMPANIES REPORTING EARNINGS Tuesday: Autozone, Inc. (AZO), Intuit, Inc. (INTU). Wednesday: Nvidia Corporation (NVDA), Okta, Inc. (OKTA), Workday, Inc. (WDAY), Dollar General (DG), Snowflake, Inc. (SNOW). Thursday: Salesforce.com (CRM), Costco Wholesale Corp. (COST), Best Buy (BBY), Dell Technologies (DELL). Source: Zacks, May 21, 2021 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.Q U O T E O F T H E W E E K

“Life is the art of drawing without an eraser.”

JOHN GARDNER

T H E W E E K L Y R I D D L E

I am a word that signifies a wide natural area – but remove my first letter, and you are left with a word signifying a narrow urban corridor. What word am I?

LAST WEEK’S RIDDLE: A girl has as many brothers as sisters, but each brother has only half as many brothers as sisters. How many brothers and sisters are there in the family?

ANSWER: The family has four sisters and three brothers.

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2021 FMG Suite. CITATIONS:

- The Wall Street Journal, May 21, 2021

- The Wall Street Journal, May 21, 2021

- The Wall Street Journal, May 21, 2021

- CNBC, May 19, 2021

- FoxBusiness.com, May 20, 2021

- CNBC, May 19, 2021