Broad equity finished higher for the week in spite of a stronger-than-expected jobs report.

- The S&P 500 was up near-record levels for the week, gaining 1.32%

- The Dow Jones Industrial Average was up by 0.29%

- The Nasdaq Composite finished higher by 2.38%

- The 10-year Treasury closed at 4.43%

Turning the calendar to a new month of the year, the first week in June provided important data points to gauge the overall health of the U.S. economy.

The Manufacturing Purchasing Managers’ Index (PMI) for the month of May was released with a reading of 48.7, suggesting the industry is in contraction territory. Additionally, the Institute for Supply Manufacturing (ISM) non-manufacturing PMI for the month of May was released with a reading of 53.8, indicating that the service industry is in expansionary territory.

Current labor market conditions were showcased through the number of current job openings in the Job Openings and Labor Turnover Survey (JOLTS) measure for April. The metric came in lower than economists anticipated, as expectations were for 8.370 million job openings, but the reading came in at 8.059 million. This marks the lowest level in more than three years and is a potential indication that companies may be taking a more conservative approach to hiring. Overall, however, the labor market data remains objectively strong, as compared to historical figures. Furthermore, alongside the measurement of current open positions, the change in average hourly earnings was released for May at a 0.4% change. This reading, higher than the previous month’s measure at 0.2%, signals economists about a potential expansion in the labor market.

In other economic news, economists were expecting that approximately 190,000 jobs would have been added to the U.S. economy in May; however, the actual number came in at 270,000. According to the Bureau of Labor Statistics, the top three job sectors that lead the new additions in May were healthcare and social assistance, government, and leisure and hospitality. Additionally, the unemployment rate remained at or below 4% for the 28th consecutive month.

2024 – The Year of the Elections

The year 2024 will be one of the largest election cycles on record. Over 50 countries are headed to the polls this year which will affect over half of the world’s population.

Some of the most consequential elections that wrapped up earlier in the year included Taiwan, Pakistan, Russia, and South Korea, just to name a few. Two other elections – Mexico and India – wrapped up early last week.

Mexican Election

Claudia Sheinbaum of the Morena party won the highest share of the vote ever on Sunday to become Mexico’s first woman and first Jewish president. Over 99 million voters participated in the election, which was the largest general election ever recorded in Mexico’s history.

President-elect Sheinbaum is the protégé of Mexico’s current president Andrés Manuel López Obrador (AMLO). In a perhaps more surprising turn of events, the Morena party will have a qualified majority in the House of Representatives and will be just shy of a qualified majority in the Senate.

The markets did not react well to the news, sending the peso and the Mexican stock market sharply down. There are concerns among investors that constitutional amendments could reduce government checks and balances.

As of the end of 2023, Mexico overtook China as the leading source of goods imported by the U.S. for the first time in more than two decades. More recently, April imports from Mexico were the highest on record. Separately, Canada also overtook China earlier this year in the amount of goods imported. This demonstrates the U.S. commitments to diversifying the supply chain to countries that are more amiable and closer in proximity.

Indian Election

India recently closed its six-week election that began in April. India’s incumbent Prime Minister Narendra Modi and his Bharatiya Janata Party (BJP) won a tighter-than-expected race. Despite this win, the BJP only won 240 seats in parliament, failing to secure the 272 to 300 seats that were expected. This means that the BJP party is losing popularity even as PM Modi’s popularity remains high.

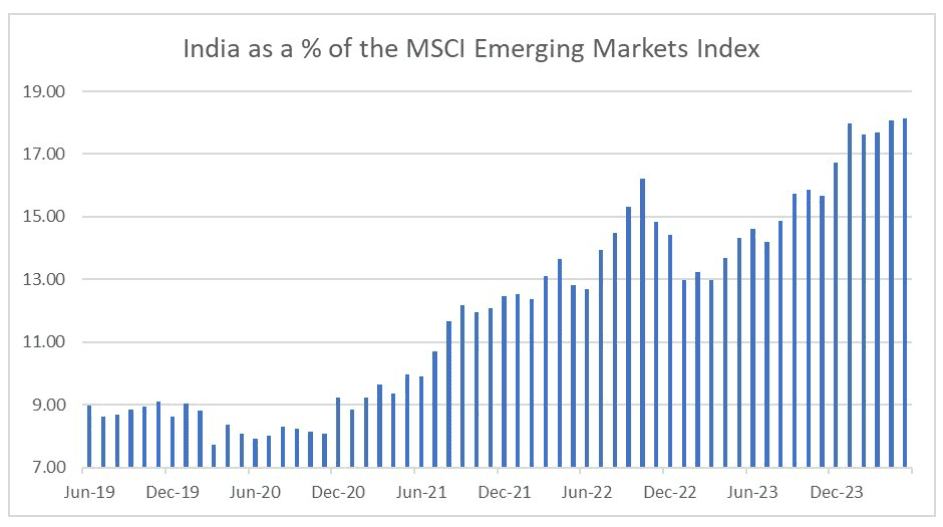

India’s equity markets reacted poorly to the announcement, declining sharply. India recently became the world’s most populous country and has increasingly become a more important constituent of the MSCI Emerging Markets Index. Over the past five years, India made up as little as 7.75% of the index, but has grown to over 18% as of the end of last month.

Source: Morningstar Direct

Other elections to look out for in the second half of the year include the European Union, Great Britain, Venezuela, and of course, the United States.

At the beginning of the week, the Consumer Price Index (CPI) for the month of May will be released. Currently, May’s reading is forecasted to remain unchanged from April’s 0.3% reading. Additionally, the Producer Price Index (PPI) for the month of May will be released, measuring the change in input prices of raw, semi-finished, or finished goods and services. If the PPI does increase, a portion of the increased input costs could be pushed onto consumers, making goods and services more expensive.

Midway through the week, the Federal Open Market Committee (FOMC) will make a statement and release their economic projections over the next two years.

Later in the week, initial jobless claims will measure the number of people who filed for unemployment insurance for the first time during the past week. A higher-than-forecasted reading indicates a bearish labor market, while a lower-than-forecasted reading indicates a bullish market. Alternatively, the week’s U.S. Baker Hughes total rig count will be released. This measure has consistently stayed at 600 rigs for two consecutive weeks. However, last week marked the first turn in the trend, decreasing the count to 594 rigs. Economists will be watching to see if this trend continues. Furthermore, weekly crude oil inventories will be released, which will give insights into the price of oil.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.