Market Commentary | Week of August 26th, 2024

Week in Review…

Stocks and risk assets continued their positive trend as all eyes focused on Jackson Hole and comments from Fed Chair Jerome Powell.

- The S&P 500 rose 1.45%

- The Dow Jones Industrial Average increased by 1.27%

- The Nasdaq Composite finished up 1.40%

- The 10-Year Treasury closed at 3.80%

The big news last week was on Friday as the highly anticipated speech by Fed Chair Powell was led with the words, “The time has come for policy to adjust,” leading stocks and bonds to rally as investors anticipate rate cuts this year. Powell also stated that the Fed would support the labor market as “the upside risks to inflation have diminished, and the downside risks to employment have increased.” The Fed’s next meeting for a potential rate cut is in mid-September, with markets predicting a 35% probability of a rate cut higher than 0.50%.

In other news, on Thursday the Department of Labor (DOL) released jobless claims showing initial jobless claims in line with forecasts of 232,000 for the trailing week. For continuing jobless participants, claims came in less than expected at 1,836,000 versus 1,870,000 forecasted.

Manufacturing and Services Purchasing Managers’ Index (PMI) for August (preliminary release) came out on Thursday from Markit, with Manufacturing PMI coming in at 48, below the market’s forecast of 49.5. Services PMI came in slightly better with the index reading coming in at 55.2 versus 54 forecasts, showing improving conditions for the sector.

Finally, housing data was released for July. Existing home sales were released with month-over-month sales matching forecasts of 1.3%. This is significantly better than last month’s revised sales of -5.1%. Year-over-year, existing home sales slightly beat forecasts with 3.95 million versus 3.94 million for the trailing twelve months. For new home sales, July significantly beat forecasts with sales month-over-month coming in at 10.6% versus 1.0%. Year-over-year, new home sales beat expectations with 739,000 versus 624,000 sales for the trailing twelve months.

Spotlight

The Surprising Economic Benefits of GLP-1 Drugs on the U.S. Economy

Weight-loss drugs such as GLP-1s are expected to have a growing impact across the food, beverage, and consumer goods sectors as people eat less and make healthier choices. Since these drugs work by decreasing appetite, the resulting reduction in calorie intake is affecting not only the amount, but also the types of food consumers eat. Changes in consumers’ diets could lead to a more dependable workforce and a stronger economy.

According to the Mayo Clinic, doctors know that GLP-1s appear to help curb hunger by slowing the movement of food from the stomach into the small intestine. As a result, consumers may feel full faster and longer, in turn eating less and reducing their calorie intake by 20% to 30% each day. Research has found that such drugs may lower the risk of heart diseases, strokes, and kidney disease. Consumers taking these drugs have seen their blood pressure and cholesterol levels improve as well.

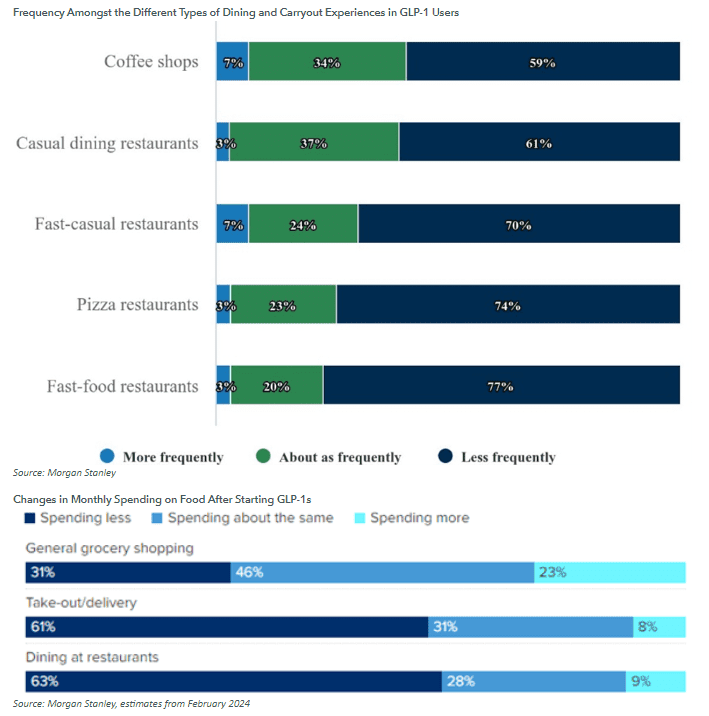

As mentioned by Morgan Stanley, it’s estimated that around 9% of the U.S. population will take GLP-1s by 2035. With the expected increase in usage, analysts have stated, “there is growing evidence that the drugs have a meaningful impact on consumer behavior and spending on groceries and restaurants.” Additionally, the firm has also stated that GLP-1s will be a manageable long-term pressure on restaurants, but not an “existential risk.” Restaurants offer a specific convenience and/or experience in addition to food, which will not change with GLP-1 usage, but some restaurants may have to adapt to health-conscious consumer behaviors. Users reported a reduction in the consumption of alcohol, drugs, and tobacco, as GLP-1 drugs can weaken the brain’s association between feelings associated with pleasure. Inevitably, the food, beverage, and restaurant industries could see softer demand, particularly for unhealthier foods and high-fat, sweet, and salty options. Notably, it was also indicated that about 40% of participants reported smoking traditional cigarettes at least weekly before starting a GLP-1, but that number declined to about 24% after treatment, and weekly e-cigarette use similarly fell from about 30% to about 16% of consumers.

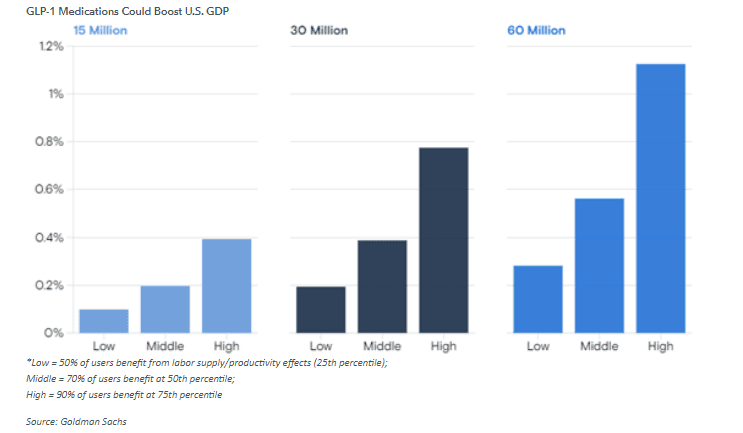

Goldman Sachs predicts the beneficial effects of GLP-1s could raise U.S. gross domestic product (GDP) levels by at least 0.4% in the future. More broadly speaking, they could increase GDP by 1.3%, which is equivalent to about $360 billion per year.

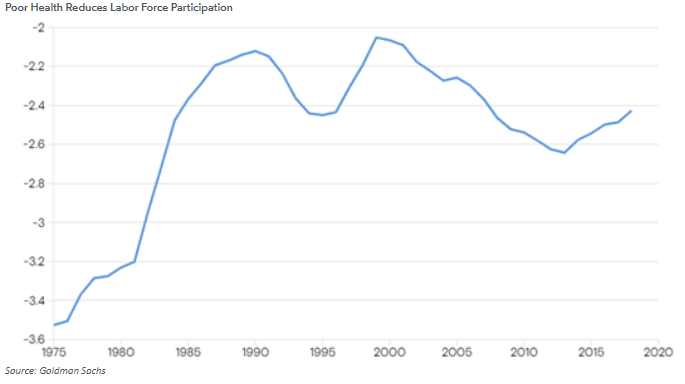

Poor health is estimated to decrease GDP by over 10% each year due to lost work from sickness, disability, early deaths, and caregiving. People who report “fair” or “poor” health are significantly less likely to seek employment, which has subtracted two to three percentage points from the overall labor force participation rate over the last 30 years. Health-related reasons reduce the number of days worked in the U.S. by about 2% each year. Short-term illnesses account for most of the lost time, but chronic health conditions also account for a substantial share.

Academic studies suggest obesity-related disease and illnesses shave about 3% from per capita output from both missed workdays and lost productivity, or more than 1% from total output when over 40% of the U.S. population that suffers from obesity is factored in. Although these drugs are expensive, economists predict the number of Americans treated with GLP-1 therapies will triple to 30 million by 2028, with upside to as many as 70 million. That could mean a 0.4% boost to U.S. GDP, or more than 1% if the drugs’ uptake comes in at the high end. According to Goldman Sachs, “If GLP-1 usage ultimately increases by this amount and results in lower obesity rates, we see scope for significant spillovers to the broader economy.”

As the usage of GLP-1 drugs rises, along with their diverse therapeutic benefits, many Americans are likely to become healthier, positively influencing the overall economy. Consequently, businesses may benefit from a more dependable workforce, leading to higher profit margins and increased wages due to fewer missed workdays, ultimately fueling further economic growth.

Week Ahead…

This week, investors will get a better look at inflation and growth as both GDP and personal consumption expenditures (PCE) will be released.

On Monday, durable goods order data from the Census Bureau will be released for July. The market forecasts a reversal of last month’s -6.7% with forecasts for July expected at 4.0%. Durable goods orders are the change in the total value of new orders for long-lasting manufactured goods, including transportation.

Tuesday will see the Conference Board release consumer confidence measurements for August. Forecasts are expected to be less than last month’s reading with 100.2 forecast versus last month’s reading of 100.3.

On Thursday, we will get the first preliminary look at Q2 GDP numbers. The market is forecasting 2.8% for Q2 which is unchanged from last quarter’s 2.8%, showing that the economy is continuing to expand.

Finishing off the week, we will get core PCE price index for July. There is no forecast for the month, but last month’s readings were 0.2% month-over-month and 2.6% year-over-year. Additionally, Chicago PMI for August will be released with investors forecasting a slight decline in expansion with a forecast of 44.4 versus 45.3 for the previous month.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.