Market Commentary | Week of January 13th, 2025

Week in Review…

Major market indices ended the week lower over concerns surrounding rising inflation:

- The S&P 500 closed at -1.94%

- The Dow Jones Industrial Average was lower at -1.86%

- The tech-heavy Nasdaq fell to -2.34%

- The 10-Year Treasury yield concluded at 4.77%

Inflation remained a significant theme this week. The ISM Services Purchasing Managers Index (PMI) for December surpassed expectations at 54.1, indicating a robust expansion in the services sector. However, a notable driver of this increase was the ISM Non-Manufacturing Prices index, revealing higher input costs for service providers. This suggests that inflationary pressures may be persisting. The bond market reacted negatively to this news, with the 10-year Note Auction climbing to 4.68% and the 30-year Bond Auction rising to 4.913%. The University of Michigan Inflation Expectations survey reinforced these concerns, showing both 1- and 5-year expectations significantly higher than anticipated.

Several labor reports last week pointed to a strong economy. The Job Openings and Labor Turnover Survey (JOLTS) report for November showed a higher-than-expected 8.098 million openings, indicating continued labor demand. This trend was further supported by lower-than-expected initial and continuing jobless claims. Friday brought more positive labor market news, with Nonfarm Payrolls adding 256,000 jobs in December, exceeding expectations by a significant margin. The unemployment rate also dipped to 4.1% from 4.2%.

Given this week’s data, market participants appear less optimistic about the Federal Reserve lowering interest rates. The persistence of inflationary pressures raises concerns about the potential for reigniting inflation, making the market less certain about the Fed’s ability to cut rates.

Spotlight

Initial Look at Investment Impact of the California Fires

The recent wildfires in California have had a devastating economic impact. Preliminary estimates suggest that the total damage and economic loss could range between $135 billion and $150 billion. This makes the current wildfires potentially the costliest in U.S. history, surpassing previous records. In this week’s spotlight, we look at the initial investment impact for investors regarding the fires.

Equity and Debt Concerns

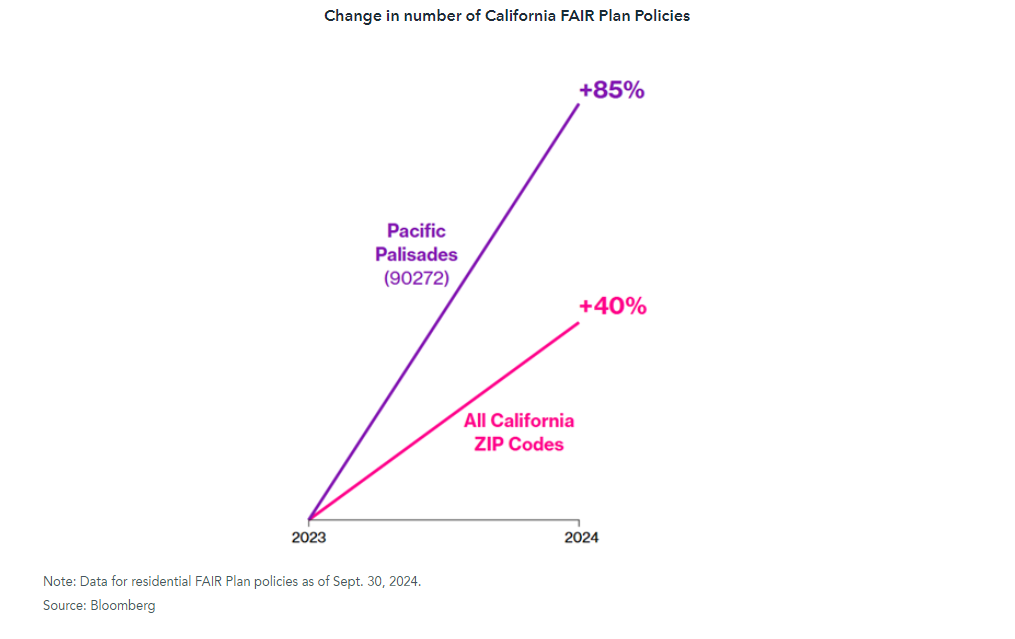

The recent wildfires in California have significantly impacted insurance companies, leading to substantial insured losses. Some insurance companies have tried to mitigate their risk and avoid certain areas. For instance, State Farm dropped around 1,600 policies in Pacific Palisades before the fires, reflecting a broader trend of insurers pulling back from high-risk areas. Allstate and Farmers Insurance have also halted underwriting in certain regions of California, leaving many homeowners relying on the California FAIR Plan (FAIR Plan).

The financial strain has led to increased premiums and stricter underwriting practices for those willing to still insure. Those with exposure to the current fires such as Mercury Insurance and Allstate have seen their stocks drop significantly due to the fires. Additionally, the state has implemented a one-year moratorium on the cancellation or non-renewal of homeowners insurance policies in affected areas to provide some relief which could lead to longer term effects for those with exposure.

Within the insurance market, concerns around catastrophe bonds (cat bonds) have fortunately been minimal. Cat bonds are financial instruments used by insurers to transfer the risk of catastrophic events, like wildfires, to the capital markets. Approximately 12% of the $50 billion cat bond market is currently exposed to wildfire risk. Despite the recent wildfires in California, many cat bonds are expected to be minimally affected because they often bundle fire risk with larger perils like hurricanes. However, there is still concern that subsequent natural disasters could trigger losses, especially if cumulative loss thresholds are reached. In the marketplace, investors are also demanding higher interest payments to compensate for the increased risks posed by climate change and rising property values.

Municipal Market Concerns

Like many other states, California offers a public insurance option for homeowners. The FAIR Plan acts as the insurer of last resort for homeowners who can’t secure coverage in the private market, particularly in wildfire-prone areas. Funded primarily by policyholder premiums, the FAIR Plan can also request financial support from the California Infrastructure and Economic Development Bank (IBank) through bond issuance. The recent wildfires have increased pressure on the FAIR Plan, resulting in higher premiums and greater demand for coverage. IBank assists by issuing bonds to ensure the FAIR Plan has sufficient funds to meet its claims obligations. Additionally, IBank invests in wildfire risk reduction and disaster relief programs to help mitigate the impact of wildfires. As of June 30, 2023, IBank has issued a total of $52.5 billion in bonds, highlighting its significant role in financing public and private projects.

Investment Impact

While data specific to capital needs from IBank to FAIR Plan is not available, investors with exposure to California municipal bonds should take additional due diligence to their holdings to understand their potential exposure to IBank. Additionally, investors in municipal bond mutual funds and ETFs should pay attention as California is typically one of the largest state exposures in these types of funds. With wildfire concerns, there could be a drop in most CA municipal bond names as investors continue to reassess the risk of not just the current effect of municipalities but of the entire state.

In regard to equity and debt concerns, investors should understand their exposure to both the insurance and reinsurance market within their portfolios. Along with equity exposure, investors should also look at any catastrophe bond exposure they may have in their fixed income holdings, specifically within certain income focused mutual funds and ETFs. While exposure in most funds may be limited currently, if bond traders can demand higher coupons on these bonds, we may start to see exposure to these bonds increase within core-plus and multi-sector bond funds focused on income.

Week Ahead…

This week, several key economic indicators are set to be released, providing valuable insights into the current state of the economy. One of the most anticipated reports is the Consumer Price Index (CPI), which measures the average change in prices paid by consumers for goods and services. This report is crucial for understanding inflation trends and how they might impact purchasing power and the cost of living. Additionally, the Consumer Inflation Expectations report will be released, offering insights into how consumers perceive future inflation, which can influence spending and saving behaviors.

Another important indicator to watch is the Retail Sales Data. This report will show the total receipts of retail stores, offering a glimpse into consumer spending habits. Strong retail sales can indicate a healthy economy with confident consumers, while weaker sales might suggest economic challenges or shifts in consumer behavior. Alongside this, the Producer Price Index (PPI) will be released, measuring inflation at the wholesale level. This index reflects the average change over time in the selling prices received by domestic producers for their output, providing a broader view of inflationary pressures in the economy.

Additionally, the unemployment claims report will be released detailing the number of individuals who filed for unemployment insurance for the first time. This data is a key measure of the job market’s health and can signal changes in employment trends. The Industrial Production report will measure the output of the industrial sector, including manufacturing, mining, and utilities, providing insights into the overall industrial activity. The Crude Oil Inventories report will also be released, indicating the weekly change in the number of barrels of commercial crude oil held by U.S. firms, which can impact oil prices and broader economic conditions.

Lastly, the housing starts report will indicate the number of new residential construction projects that have begun during the month. This is an important indicator of the housing market’s health and can reflect broader economic conditions. Together, these indicators will offer a comprehensive snapshot of economic health and trends across various sectors.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.