Market Commentary | Week of September 16th, 2024

Week in Review…

U.S. stock markets rallied after a significant downturn last week. A recap of the week, as of September 13, 2024:

- The S&P 500 surged 4.0%, marking its strongest weekly gain of the year

- The Dow Jones Industrial Average climbed 2.6%, recovering much of its recent losses

- The Nasdaq Composite outperformed other indices, rallying to 5.9% for the week

- The 10-Year Treasury yield eased at 3.68%, down from recent highs

The U.S. economy showed signs of continued moderation in inflation this week, as evidenced by the latest Consumer Price Index (CPI) data. The headline CPI reached a three-year low of 2.5%, extending its cooling trend for the fifth consecutive month. Meanwhile, the Core CPI, which excludes volatile food and energy sectors, remained relatively stable at 3.2%.

In the energy sector, the Organization of the Petroleum Exporting Countries (OPEC) reduced its forecast for global oil demand growth following a delay in planned production increases, aiming to support falling oil prices. As a result, benchmark U.S. crude prices plummeted to their lowest level since December 2021, though they have since recovered slightly. This downward pressure on oil prices is expected to continue providing a tailwind for headline inflation.

Thursday’s jobless claims report revealed a slight increase compared to the previous week. However, the data showed no indications of widespread layoffs, despite the ongoing cooling in the labor market.

The combination of weakening labor market data from earlier this month and the recent slowdown in inflation has led to a bull steepening of the yield curve. Notably, the yield curve inversion, measured as the difference between the 10-year and 2-year Treasury yields, has turned positive after remaining inverted for over a year. Over the past month, the 10-year Treasury yield has declined by 22 basis points to 3.68%, while the 2-year yield has decreased by 37 basis points to 3.64%

Spotlight

Emerging Market Bonds

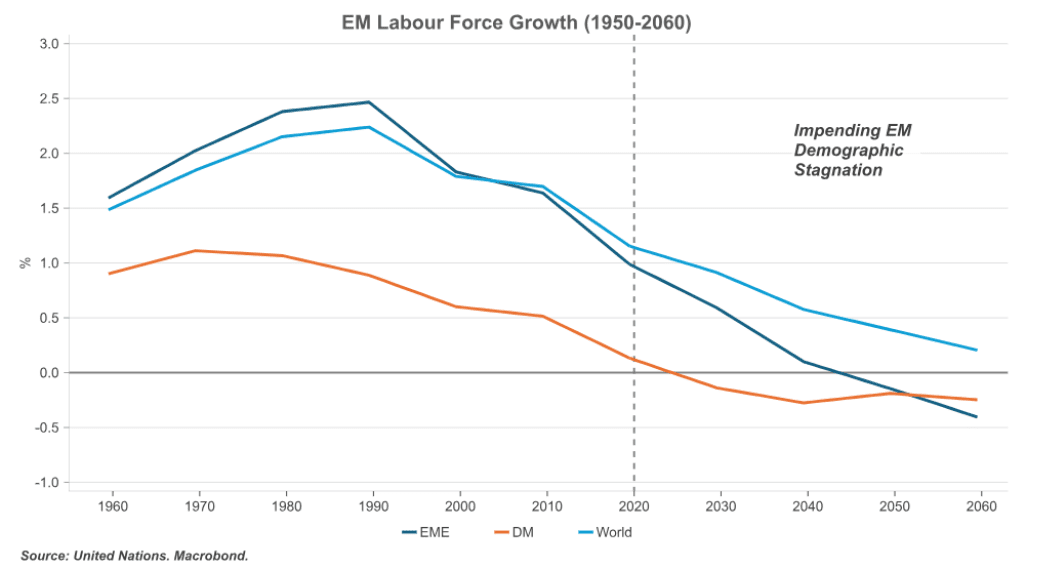

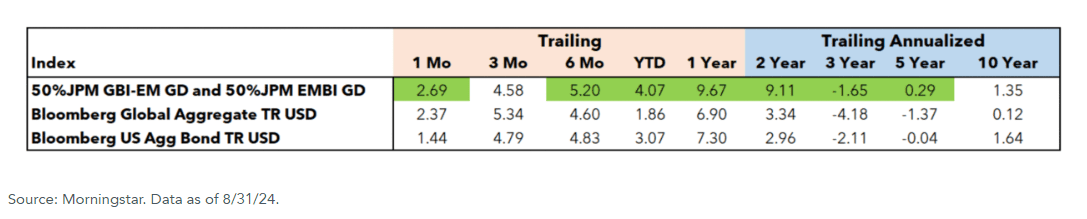

With rate cuts in the U.S. imminent along with already lower rates in most developed countries, one of the more particular asset classes over the past few years has been emerging markets, specifically emerging markets debt. For most diversified investors, the exposure to the emerging markets world has been mostly on the equity side. But with a more developed emerging markets sector as well as higher population growth, we will look to see if it makes sense for investors to consider emerging markets debt.

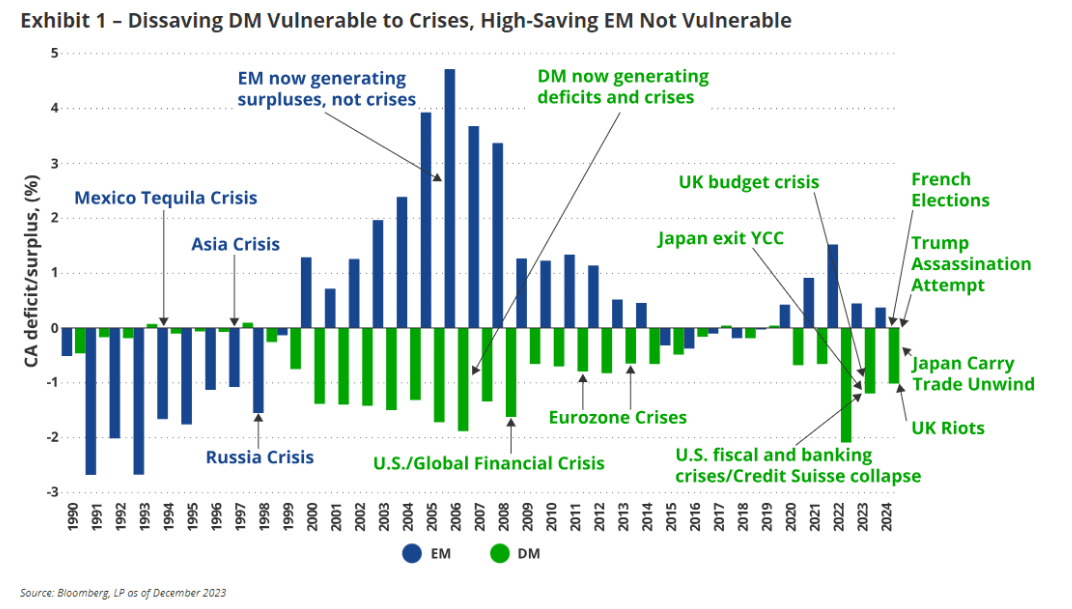

From a fundamental standpoint, emerging markets have continued to carry current account surplus as a whole versus developed markets. The savings have led emerging markets to have fewer crises in the last 10 years, despite some challenges from China (2023 real estate crisis) and Argentina (2020 default) over the past five years.

While emerging markets have seen a decline in the growth rates they experienced in the post-World War II era, the economies continue to see higher growth rates than those of developed markets. In 2020, emerging market economies grew at an estimated 1% which is still significantly higher than the developed markets.

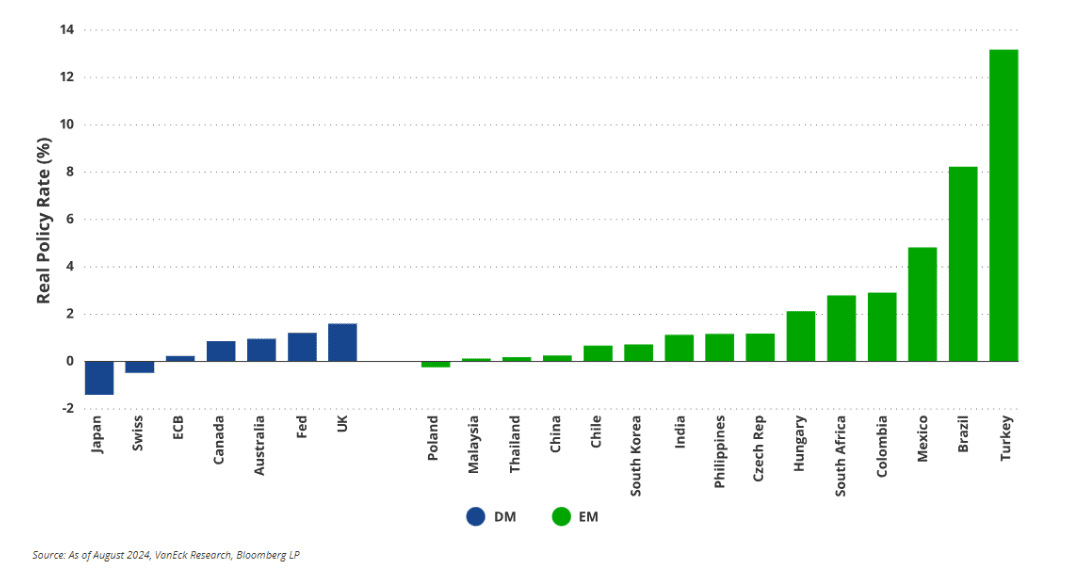

Moving from fundamentals to discussing rates, emerging market sovereign debt has exhibited higher real rates. What is more curious is the fact most emerging markets have kept rates high (mostly due to the influence of U.S. rates on emerging markets monetary policy) which comes to question if emerging market central banks are waiting for the Fed to cut rates to cut themselves. Given the high level of real rates in this sector, a cut by the Fed could lead to a significant rally in emerging markets.

Finally, emerging markets debt has had strong performance in recent years relative to global bonds and U.S. bonds. While rates do remain very elevated in emerging markets, we could continue to see strong performance if we see rate cuts by emerging market central banks. This, along with diversification away from typical credit sectors in fixed income, could provide an opportunity for investors to look at emerging markets debt as a potential sector to allocate going forward.

Week Ahead…

Next week, the financial world’s attention will be focused on the Federal Open Market Committee (FOMC) meeting on Wednesday and the Federal Reserve’s decision on interest rates. However, like all things finance related, the details will matter and there will be several key economic reports released as well.

The Fed’s decision on the federal funds rate will dominate Wednesday’s headlines. Market sentiment suggests that a rate cut is highly likely, with the main question being the magnitude of the reduction. Fed funds futures indicate expectations of a cut between 25 to 50 basis points. It’s worth noting that a 50 bps (or greater) cut might be viewed negatively, potentially raising concerns about the overall health of the economy.

Tuesday will see the release of month-over-month retail sales figures. This data serves as a crucial indicator of consumer demand, which is a significant driver of economic activity. As such, retail sales can be viewed as a barometer of the U.S. economy’s health.

Wednesday will bring another week of crude oil inventory reports. Following two weeks of higher-than-expected crude oil demand, it will be important to monitor if this trend continues. Sustained high oil demand could be interpreted as a sign of ongoing economic strength.

On Thursday, the National Association of Realtors will release August’s Existing Home Sales data. This report will provide the annualized number of existing residential homes sold during August, offering valuable insights into the strength of the U.S. housing market and overall housing demand.

Underlying the Fed’s decision, a crucial theme of economic demand will emerge throughout the week. As the dust settles, market participants should have a clearer understanding of consumer demand (through retail sales), housing market demand, and whether the economy continues to exhibit strong demand for oil. These indicators will collectively paint a picture of the current state of U.S. economic activity.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.