Market Commentary | Week of September 3rd, 2024

Week in Review…

Stocks and risk assets ended the week mixed following Federal Reserve Chair Jerome Powell’s speech on August 23 at the Jackson Hole Economic Symposium.

- The S&P 500 edged up 0.24%, marking its fifth consecutive monthly gain

- The Dow Jones Industrial Average outperformed, rising 0.94%.

- The tech-heavy Nasdaq Composite finished lower, with a -0.92% decrease

- The 10-Year Treasury closed at 3.92%

The past week provided valuable insights into the state of the U.S. economy, with key data releases on inflation and growth painting a picture of resilience despite high interest rates.

Durable goods orders for July showed a remarkable turnaround, increasing by 9.9% compared to the previous month’s 6.7% decline. This substantial 248% improvement indicates a significant appreciation in the value of new orders for long-lasting manufactured goods, including transportation.

The Conference Board’s consumer confidence measurements for August revealed increased optimism among consumers following Federal Reserve Chair Powell’s Jackson Hole speech on Tuesday, which hinted at potential future rate cuts.

Thursday’s preliminary Q2 gross domestic product (GDP) numbers surpassed forecasts, coming in at 3.0% versus the expected 2.8%. This robust figure demonstrates continued economic expansion.

The core personal consumption expenditures (PCE) price index for July remained steady at 0.2%, showing no change from the previous month. Meanwhile, Chicago’s purchasing managers’ index (PMI) for August exceeded expectations with a reading of 46.1, suggesting expansion in the manufacturing sector.

Spotlight

What Are Liquid Alternatives?

As financial professionals seek to enhance portfolio diversification and manage risk for clients, liquid alternatives have emerged as an increasingly popular option. These investment vehicles aim to provide access to hedge fund-like strategies within a more accessible mutual fund or exchange-traded fund (ETF) structure, making them available to a broader range of investors.

Liquid alternatives (liquid alts) are investment funds that employ non-traditional strategies while offering daily liquidity. . These funds employ several techniques like short-selling, leverage, and derivatives to pursue their objectives.

Key Features of Liquid Alternatives

- Daily liquidity: Easily bought and sold, unlike traditional hedge funds

- Lower investment minimums: Increased accessibility for a wider range of investors

- Stricter regulatory oversight and transparency requirements

- Regular disclosure of holdings and performance

Constraints and Trade-offs

- Limited strategy flexibility due to regulatory restrictions on leverage and illiquid assets (typically 15% illiquidity threshold)

- Potential for lower returns compared to less liquid hedge fund strategies

- Regular disclosure requirements may impact strategy effectiveness

Liquid alternatives provide synthetic exposures to more liquid asset classes through options and derivatives. However, they are not direct replacements for semi-liquid funds or private market assets such as real estate, private credit, and private equity. Per Cerulli Associates, the liquid alternative vehicles complement rather than substitute for the semi-liquid strategies that are focused on harvesting illiquidity premiums.

Growth Since the Global Financial Crisis

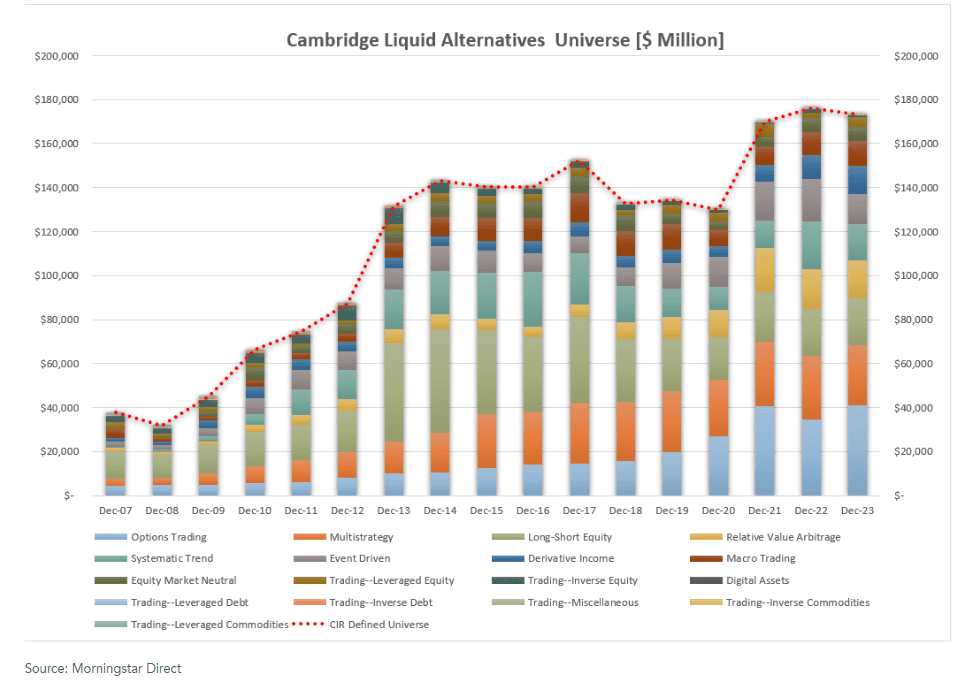

The liquid alternatives universe has experienced significant growth since the 2008 financial crisis. Using the Cambridge Liquid Alts Universe as a reference, assets in this sector have grown at a compound annual growth rate (CAGR) of 9.40% between 2007 and 2023. Using the Morningstar Flows data:

- Year-to-date, Options Trading, Multi-Strategy, and other strategies collectively account for approximately 50% of the asset base in the universe, with Options Trading dominating at 25%

- Digital assets have emerged as a notable segment within liquid alternatives, amassing $124 billion in net assets according to Morningstar. This figure includes the recently launched Spot Bitcoin and Ethereum ETFs, highlighting the growing interest in cryptocurrency-based investment products.

The July 2024 Trends in Alternative Investments report, published by Escalent, indicates that investors’ desire for enhanced diversification and downside protection has primarily driven the growth of the liquid alternatives’ investment universe. According to the report, millennials show particular interest in real estate investment trusts (REITs), closely followed by liquid alternatives, private equity, and private credit. Additionally, Registered Investment Advisors (RIAs) demonstrate a strong preference for liquid alternatives, with some reporting over 20% of their portfolio allocation to these investments.

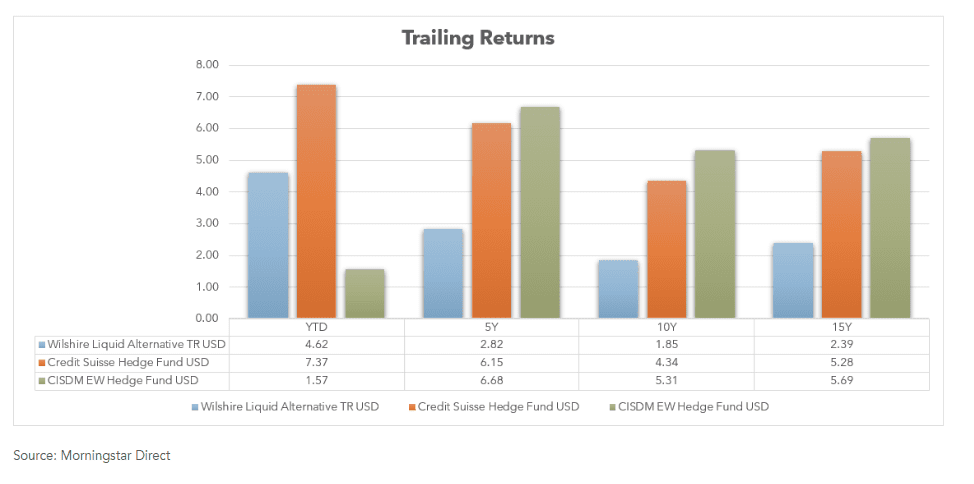

When evaluating the performance of liquid alternatives, financial professionals may consider the Wilshire Liquid Alternative Index as a proxy for the broader universe. It can be seen that liquid alternatives have generally trailed both asset-weighted and equal-weighted hedge fund managers across various trailing periods. Manager selection plays a crucial role when accessing liquid alternatives, as performance dispersion can be quite significant, similar to their hedge fund siblings.

The Wilshire Liquid Alternative Index℠ measures the collective performance of the five Wilshire Liquid Alternative strategies that make up the Wilshire Liquid Alternative Universe.

Credit Suisse Hedge Fund USD measures the performance of approximately 9,000 funds. It is an asset-weighted hedge fund index and includes only funds with a minimum of US$50 million under management, a 12-month track record, and audited financial statements

The CISDM Equal Weighted Hedge Fund Index is a benchmark index that measures the overall performance of the hedge fund universe on the Funds included in the Morningstar CISDM Database. The latter tracks qualitative and quantitative information for more than 12,000 hedge funds, and funds of funds since 1994.

Generally, performance can vary widely among different strategies; liquid alternatives have generally provided lower volatility compared to equities, with returns that fall between stocks and bonds over longer periods.

The growing popularity of liquid alternatives has drawn increased regulatory attention. The Securities and Exchange Commission (SEC) has intensified its focus on these complex products, emphasizing the importance of robust risk management practices, transparent disclosures, and appropriate marketing strategies. In response to this evolving landscape, Cambridge has established specific concentration guidelines for liquid alternative investments. Financial professionals can access these guidelines on the Non-Conventional Funds and Traded Securities Page on cir2.com.

Financial professionals should carefully evaluate several key factors when integrating liquid alternatives into client portfolios, including strategy selection, diversification potential, fee structures, and adherence to Cambridge’s concentration guidelines.

Week Ahead…

Markets were closed on Monday in observance of Labor Day. Upon reopening on Tuesday, the focus will shift to the August manufacturing and services PMI data. Recent readings indicate that the manufacturing sector remains in contraction territory. Forecasts suggest no change from the previous month’s figures. In contrast, the service industry has been showing a trend of improving conditions, placing it firmly in expansion territory. Economists will be closely monitoring these releases to see if these trends persist.

Midweek, the spotlight will be on the labor market with the anticipated releases of the July Job Openings and Labor Turnover Survey (JOLTS) reports. Job openings have increased over the past two readings, and forecasts predict this upward trend to continue. Additionally, August’s average hourly earnings data will be published, indicating the percentage change in wages. The past two months have shown a slight deceleration in earnings growth. Furthermore, the August unemployment rate will provide insight into the overall state of the labor market. Since May 2024, the rate has been steadily increasing month-over-month.

To conclude the week, the weekly U.S. Baker Hughes total rig count will be released. This metric serves as an indicator for potential changes in oil prices based on the number of active rigs. Over the past three weeks, there has been a marginal decrease of three active rigs, suggesting a slight decline in demand.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.