Weekly Market Commentary | Week of September 23rd, 2024

Week in Review…

This week, the market’s eyes were all on the Fed which delivered a 50-basis point cut, the first rate cut since March 2020. Markets rallied with the end of the Fed’s tightening cycle.

- The S&P 500 rose 1.36%, following the prior week’s strong rally

- The Dow Jones Industrial Average climbed 1.62%, leading major U.S. indices

- The Nasdaq Composite finished the week up 1.49%

- The 10-Year Treasury yield ended the week at 3.73%

News for the week included several key economic reports, and U.S. Federal Reserve’s Federal Open Market Committee (FOMC) meeting, who ultimately decided on Wednesday to cut the federal funds rate by 50 basis points. After the news was released, the S&P 500 rose while bond prices at the long end of the yield curve fell (interest rates rose). However, it may be too soon to read into market and bond yield movements.

Jerome Powell in his press conference articulated that this rate cut was done in support of a softening labor market, and the Fed is cutting rates prior to any large movements in unemployment. In short, the Federal Reserve is trying to avoid artificially creating a recession by keeping rates too high for too long. Only time will tell if they cut too late or too early.

Other news throughout the week pointed toward strong demand in retail sales and oil markets, weaker demand in residential real estate, and strong manufacturing conditions. Month-over-month retails sales (Tuesday) and crude oil inventories (Wednesday) both showed stronger demand than forecast;the indication being strong consumer demand is a significant driver in economic activity and provides a positive economic outlook. Demand in the residential real estate market was lower than expected; however, much of this low demand is being written off due to high mortgage interest rates. With rates now trending lower, future housing demand will be important to monitor. Finally on Thursday, manufacturing in the Philadelphia Federal district showed improving conditions in manufacturing. This was a surprise to the upside. All in all, this week’s economic reports seemed to show both economic conditions and consumer demand are better than expected.

Some key takeaways from last week: markets look to be entering a new regime, and the Federal Reserve appears to be signaling to markets, both implicitly and explicitly, that inflation is no longer the biggest threat to the economy. Consequently, the mantra of ‘higher for longer’ might be over, and an easing cycle may have begun. One thing that is clear: the Fed intends to resume its dual mandate of maximum employment and stable prices. However, we should expect Jerome Powell and the Federal Reserve to move cautiously as they will want to avoid cutting rates into strong economic activity.

Spotlight

The Ramifications of the U.S.’s Increasingly Large Amount of Debt

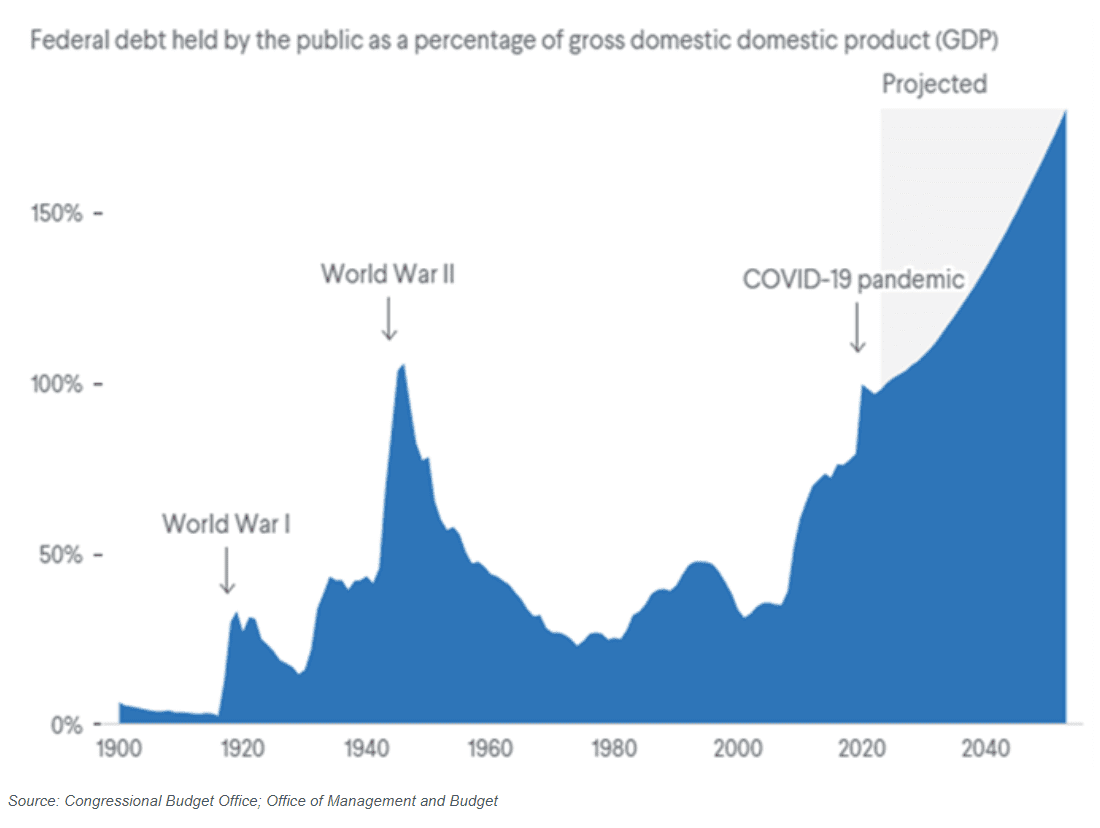

The United States’ national debt has soared to historic levels relative to the size of its economy. As interest on the national debt tops $1 trillion, many economists say that a rapidly mounting debt load could soon diminish U.S. economic growth, restrict government spending on important programs, and raise the likelihood of a financial crisis. This week we will look at the ramifications of the U.S.’s increasing debt.

The United States has run annual deficits by spending more than the Treasury Department collects in taxes – all the way up to $3.1 trillion in 2020 which is about 15% of the gross domestic product (GDP), the highest level since World War II – and the debt is predicted to continue growing each year.

U.S. Debt Projected to Soar

According to the U.S. Treasury, “from 2019 to 2021 the U.S.’s spending increased by about 50%, largely due to the pandemic.” National debt swelled during the COVID-19 pandemic as the government spent trillions of dollars to boost the economy, including stimulus checks for citizens and aid for businesses, and state and local governments. Tax cuts and stimulus programs increased government spending and decreased tax revenue caused by widespread unemployment which generally accounted for sharp rises in the national debt.

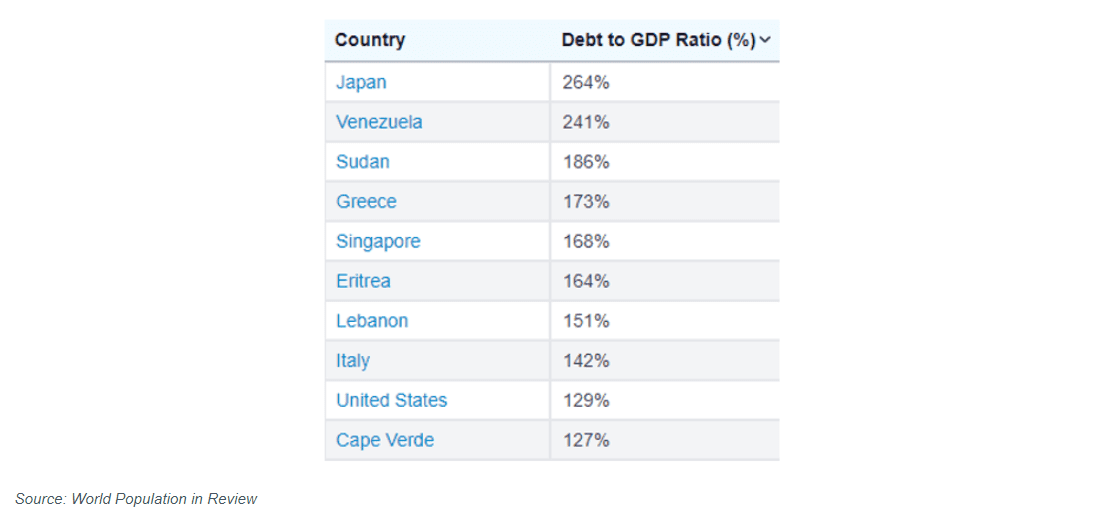

Comparing a country’s debt to its GDP reveals the country’s ability to pay down its debt. This ratio is considered a better indicator of a country’s fiscal situation than just the national debt number because it shows the burden of debt relative to the country’s total economic output, and therefore, its ability to repay it. The U.S. debt to GDP ratio surpassed 100% in 2013 when both debt and GDP were approximately 16.7 trillion. According to the World Population Review, the United States’ debt to GDP ratio for 2024 is about 129%, the ninth highest in the world.

Top 10 Countries with the Highest Debt-to-GDP Ratios (%)

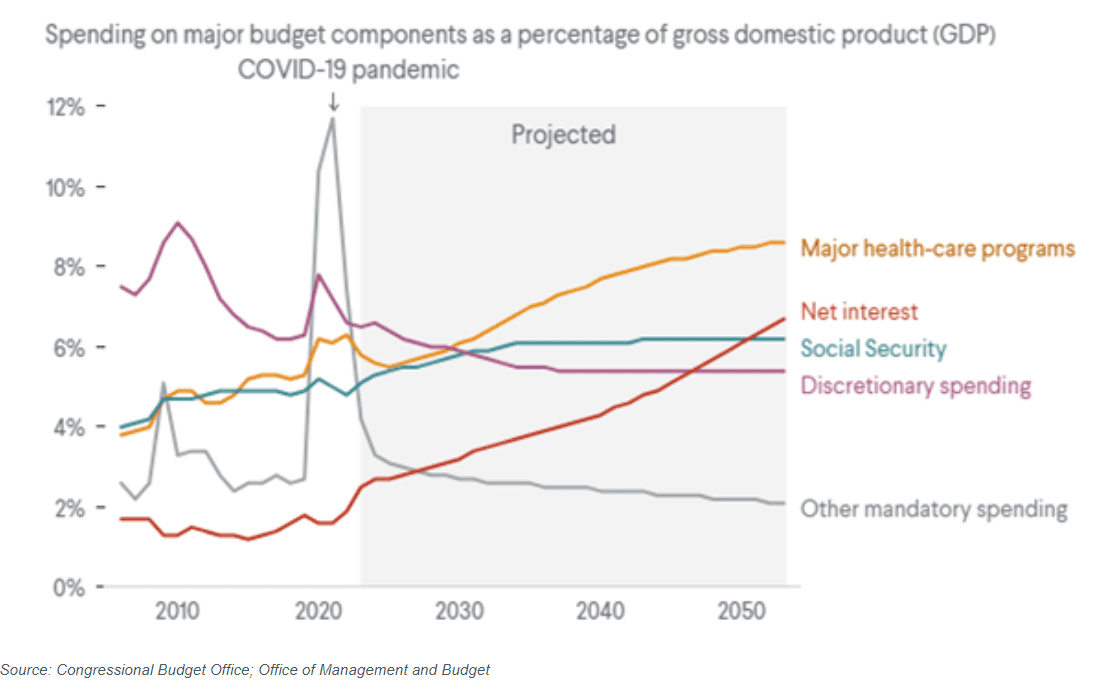

Each year, the majority of the United States’ debt budget goes toward mandatory spending, which is routine unless there is new legislation enacted altering it. Such spending primarily consists of entitlement programs such as Social Security, Medicare, and Medicaid. The remainder of the budget goes toward discretionary spending, which varies each year through the appropriations process and debt services. According to the Congressional Budget Office, healthcare is expected to increasingly utilize the U.S.’s debt budget throughout the years, which in turn will decrease the volume of discretionary spending, leaving less aid for the other aspects of the economy facing hardships.

Healthcare and Interest Payments Are Expected to Consume More of the Budget

Ramifications from the U.S.’s large amount of debt can impact the world in several ways such as creating an unstable global economy, negatively impacting the value of foreign currencies, reduction of U.S. reserves in foreign central banks, as well as restricting fiscal policy’s ability to be flexible in the event of an economic downturn or recession.

Going forward, as we surpass $1 trillion in interest on U.S. debt, investors should be cautious of their exposure to U.S. dollars (USD) and U.S. debt. While U.S. bonds have typically provided diversification from equities, allocation to non-USD bonds or real assets could provide some diversification from U.S. dollar and debt exposure.

Week Ahead…

The upcoming U.S. economic data will play a critical role in shaping market expectations regarding the pace of interest rate cuts towards the end of the year, and assessing the likelihood of a soft landing for the economy. The highly anticipated second quarter GDP report, scheduled for release on Thursday, will be closely monitored to evaluate the economy’s resilience with a tightening monetary policy over the past two years. Following a first quarter GDP report that fell short of expectations at 1.4%, the market is now expecting a rebound in growth to 3.0% during the second quarter.

Additionally, the release of the Personal Consumption Expenditures (PCE) Index on Friday will be of significant interest. The core PCE, which excludes volatile food and energy prices and serves as the Federal Reserve’s preferred inflation measure, showed a 2.6% increase in the previous release. Market participants will be looking for indications of moderation to assess potential future paths of interest rate cuts.

Furthermore, the University of Michigan’s consumer sentiment data, also set for release on Friday, will be closely observed. Despite last month’s sentiment being approximately 40% higher than the level recorded a year ago, consumers remain cautious due to substantial uncertainty stemming from the upcoming election. Forecasters anticipated that sentiment would improve next week as inflation expectations continue to decline.

These indicators will be carefully monitored by the market for insights into future Federal Reserve actions, as concerns about a softening economy remain paramount for investors.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.